All the big public sector banks announced their base rate—their benchmark rate below which they can't lend. The base rate replaces the opaque benchmark prime lending rate (BPLR). This base rate will include the bank's cost of funds and cost of running the bank.

State Bank of India (SBI) said its base rate is 7.5% while Punjab National Bank (PNB), Bank of Baroda (BoB), Union Bank, Central Bank of India, Bank of Rajasthan, Indian Bank,UCO Bank, IDBI Bank and Indian Bank announced that their base rate will be 8%. Dhanlaxmi Bank has set base rate at 7% while Federal Bank has set it at 7.75%.

So how this new rate going to impact banks and customers? CNBC-TV18’s Latha Venkatesh and Gopika Gopakumar report.

Banks announce base rates; do you think this will bring about transparency in home loan rates? Tell us.

Starting July 1, SBI will price all its new loans above 7.5%. This will be the new reference rate or base rate, which will replace the existing benchmark prime lending rate, which stands at 11%. So does it mean rates change for existing customer? Chairman OP Bhatt says the bank will work out the impact on various borrowers in a day but said he expects only marginal changes for customers.

But what if rival banks announce lower base rates? As of now the big PSUs like Punjab National Bank, Bank of Baroda, Union and Central Bank have refrained from undercutting and announced a base rate of 8%. All the private banks have decided to announce their base rate on Wednesday. So will those with lower base rates snatch customers from those with higher rates, not so says ICICI Bank’s Managing Director and Chief Executive Officer Chanda Kochhar.

SBI's Bhatt said hasn't taken a call on whether he will continue their popular 8% home loan scheme. But added that banks can offer home loan schemes at lower invitation prices, even under the base rate regime.

The fun may start if some private banks like HDFC announce a rate below 7% and try and tempt away some customers. OP Bhatt points out that SBI even now has only 3% of its loans at below 7.5% and adds that the banks can lend to these borrowers through the commercial paper route. PNB sources say that even now they don't lend below 8%. Despite these brave words observers don't rule out a rate war after July 1.

RBI had directed all the banks to switch over to the base rate system from the existing BPLR system with effective from 1 July.

All new loans sanctioned after 1 July and those falling due for renewal from 1 July, (except exempt categories as per RBI Guidelines) will now be priced with linkage to base rate.

The RBI introduced the new lending rate system or the base rate to ensure that larger borrowers do not bargain for cheaper rates from banks, distorting their asset liability management.

Natalie Wood (July 20, 1938 – November 29, 1981): Wood began acting in movies at the age of 4, and became a successful child actor in such films as Miracle on 34th Street (1947). A well received performance opposite James Dean in Rebel Without a Cause (1955), earned her a nomination for the Academy Award for Best Supporting Actress and helped her to make the transition from a child performer. Wood drowned near Santa Catalina Island, California at age 43. She had not yet completed her final film, the science fiction drama Brainstorm (1983) with Christopher Walken, which was released posthumously.

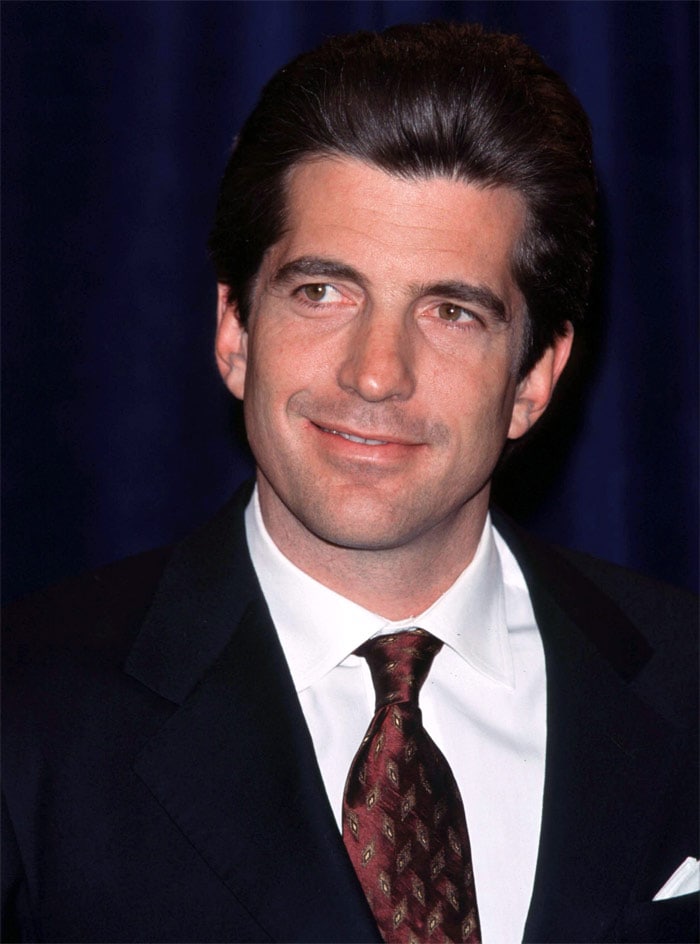

Natalie Wood (July 20, 1938 – November 29, 1981): Wood began acting in movies at the age of 4, and became a successful child actor in such films as Miracle on 34th Street (1947). A well received performance opposite James Dean in Rebel Without a Cause (1955), earned her a nomination for the Academy Award for Best Supporting Actress and helped her to make the transition from a child performer. Wood drowned near Santa Catalina Island, California at age 43. She had not yet completed her final film, the science fiction drama Brainstorm (1983) with Christopher Walken, which was released posthumously. John F. Kennedy Jr. (November 25, 1960 – July 16, 1999): The Kennedy family curse returned to haunt American socialite, magazine publisher, lawyer, and pilot John F. Kennedy Jr. as well. The only son of US President John F. Kennedy and First Lady Jacqueline Lee Bouvier Kennedy Onassis, Kennedy was killed in a plane crash along with his wife and sister-in-law on July 16, 1999.

John F. Kennedy Jr. (November 25, 1960 – July 16, 1999): The Kennedy family curse returned to haunt American socialite, magazine publisher, lawyer, and pilot John F. Kennedy Jr. as well. The only son of US President John F. Kennedy and First Lady Jacqueline Lee Bouvier Kennedy Onassis, Kennedy was killed in a plane crash along with his wife and sister-in-law on July 16, 1999. Steve Irwin (February 22, 1962 – September 4, 2006): The iconic Australian television personality, wildlife expert, and conservationist achieved worldwide fame with the television program The Crocodile Hunter, an internationally broadcast wildlife documentary series co-hosted with his wife Terri Irwin. He died in 2006 after being fatally pierced in the chest by a stingray barb while filming in Australia's Great Barrier Reef.

Steve Irwin (February 22, 1962 – September 4, 2006): The iconic Australian television personality, wildlife expert, and conservationist achieved worldwide fame with the television program The Crocodile Hunter, an internationally broadcast wildlife documentary series co-hosted with his wife Terri Irwin. He died in 2006 after being fatally pierced in the chest by a stingray barb while filming in Australia's Great Barrier Reef. John Belushi (January 24, 1949 – March 5, 1982): American comedian, actor, and musician Belushi is remembered for his work on Saturday Night Live, National Lampoon's Animal House, and The Blues Brothers. On March 5, 1982, Belushi was found dead in his room at Bungalow #3 of the Chateau Marmont on Sunset Boulevard in Los Angeles, California. The cause of death was a speedball, a combined injection of cocaine and heroin. In the photo, John Belushi (2nd L) is seen with Dan Aykroyd in The Blues Brothers.

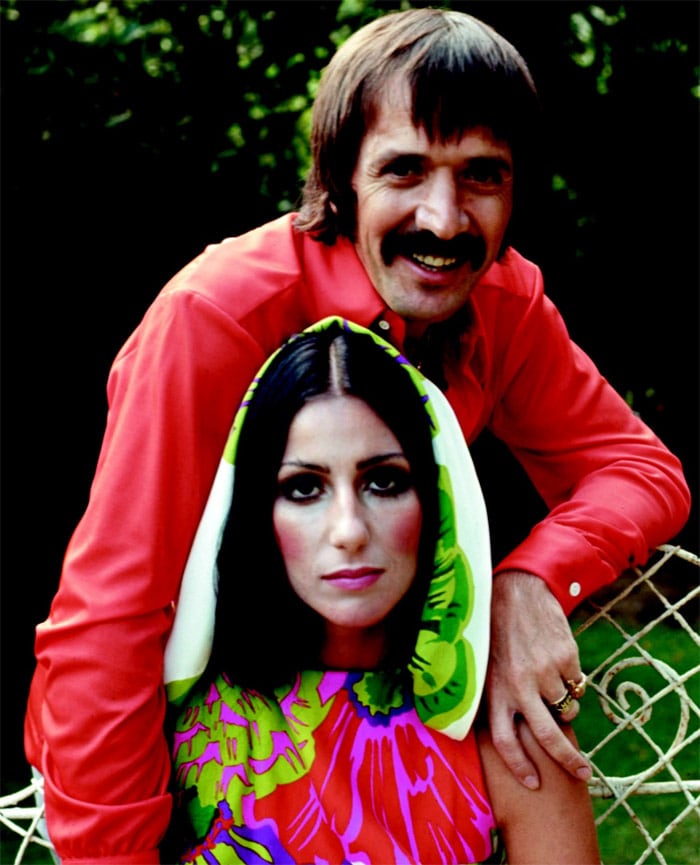

John Belushi (January 24, 1949 – March 5, 1982): American comedian, actor, and musician Belushi is remembered for his work on Saturday Night Live, National Lampoon's Animal House, and The Blues Brothers. On March 5, 1982, Belushi was found dead in his room at Bungalow #3 of the Chateau Marmont on Sunset Boulevard in Los Angeles, California. The cause of death was a speedball, a combined injection of cocaine and heroin. In the photo, John Belushi (2nd L) is seen with Dan Aykroyd in The Blues Brothers. Sonny Bono (February 16, 1935 – January 5, 1998): American record producer, singer, actor, and politician Sonny Bono's career spanned over three decades. Bono wrote, arranged, and produced a number of hit records with singles like 'I Got You Babe' and 'The Beat Goes On', although his then-wife Cher received more attention as a performer. On January 5, 1998, Bono died from injuries sustained when he struck a tree while skiing on the Nevada side of Heavenly Ski Resort near South Lake Tahoe, California. He was 62.

Sonny Bono (February 16, 1935 – January 5, 1998): American record producer, singer, actor, and politician Sonny Bono's career spanned over three decades. Bono wrote, arranged, and produced a number of hit records with singles like 'I Got You Babe' and 'The Beat Goes On', although his then-wife Cher received more attention as a performer. On January 5, 1998, Bono died from injuries sustained when he struck a tree while skiing on the Nevada side of Heavenly Ski Resort near South Lake Tahoe, California. He was 62. Jade Goody (June 5, 1981 – March 22, 2009): Audiences in India didn't get introduced to English celebrity Jade Goody under the best possible circumstances. In January 2007, Goody was a housemate in Celebrity Big Brother. During the show she was accused of racist bullying against Bollywood star Shilpa Shetty. Following her eviction from the show, she admitted her actions had been wrong and she subsequently made many public apologies. In August 2008, she appeared on the Indian version of Big Brother, Bigg Boss, but withdrew early from the show and returned to the UK after being told she had cervical cancer. In February 2009, after the cancer metastasised, she was told that it was terminal. She married Jack Tweed on February 22, 2009 and died, one month later, in the early hours of March 22, 2009.

Jade Goody (June 5, 1981 – March 22, 2009): Audiences in India didn't get introduced to English celebrity Jade Goody under the best possible circumstances. In January 2007, Goody was a housemate in Celebrity Big Brother. During the show she was accused of racist bullying against Bollywood star Shilpa Shetty. Following her eviction from the show, she admitted her actions had been wrong and she subsequently made many public apologies. In August 2008, she appeared on the Indian version of Big Brother, Bigg Boss, but withdrew early from the show and returned to the UK after being told she had cervical cancer. In February 2009, after the cancer metastasised, she was told that it was terminal. She married Jack Tweed on February 22, 2009 and died, one month later, in the early hours of March 22, 2009. John Ritter (September 17, 1948 – September 11, 2003): The American actor and comedian is perhaps best known for playing Jack Tripper in the ABC sitcom Three's Company. On September 11, 2003, Ritter felt ill while rehearsing scenes for a season 2 episode of 8 Simple Rules for Dating My Teenage Daughter. He was taken across the street to Providence Saint Joseph Medical Center, where he died later that evening. Ritter was 6 days short of his 55th birthday.

John Ritter (September 17, 1948 – September 11, 2003): The American actor and comedian is perhaps best known for playing Jack Tripper in the ABC sitcom Three's Company. On September 11, 2003, Ritter felt ill while rehearsing scenes for a season 2 episode of 8 Simple Rules for Dating My Teenage Daughter. He was taken across the street to Providence Saint Joseph Medical Center, where he died later that evening. Ritter was 6 days short of his 55th birthday. Ayrton Senna (March 21, 1960, – May 1, 1994): Brazilian racing driver and three-time Formula One world champion Senna was killed in a crash while leading the 1994 San Marino Grand Prix, and remains the most recent Grand Prix driver to die at the wheel of a Formula One car.

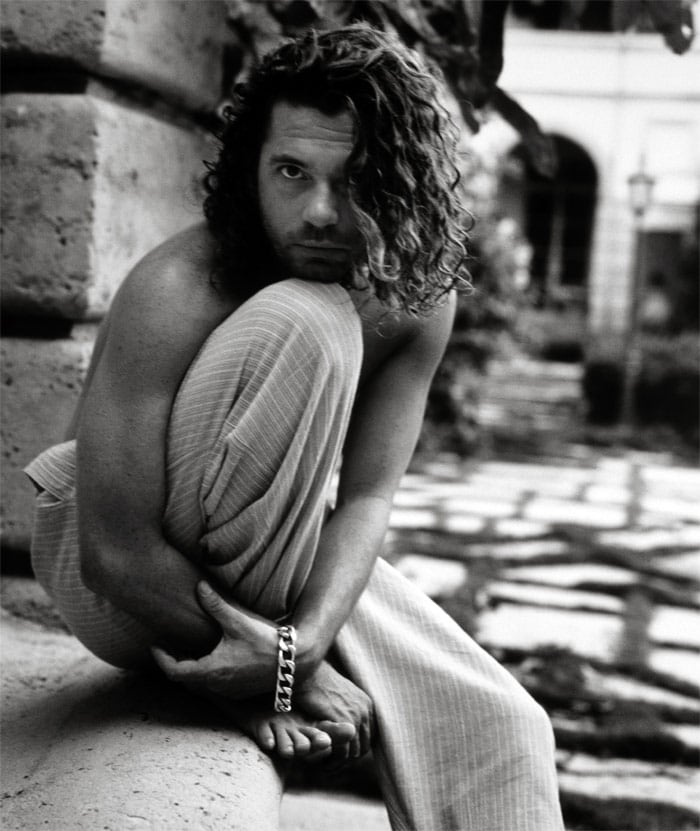

Ayrton Senna (March 21, 1960, – May 1, 1994): Brazilian racing driver and three-time Formula One world champion Senna was killed in a crash while leading the 1994 San Marino Grand Prix, and remains the most recent Grand Prix driver to die at the wheel of a Formula One car. Michael Hutchence (January 22, 1960 – November 22, 1997): The Australian singer-songwriter is most famous for his work with rock band INXS. The INXS album, 'Elegantly Wasted', was released in April 1997. Hutchence and INXS went on a world tour. The final leg of the tour was to be in Australia in November and December. However, on the morning of 22 November 1997, Hutchence, aged 37, was found dead in his room, Room 524, at the Ritz-Carlton hotel in Double Bay, Sydney. The New South Wales Coroner determined that Hutchence's death was the result of suicide. (Wikipedia)

Michael Hutchence (January 22, 1960 – November 22, 1997): The Australian singer-songwriter is most famous for his work with rock band INXS. The INXS album, 'Elegantly Wasted', was released in April 1997. Hutchence and INXS went on a world tour. The final leg of the tour was to be in Australia in November and December. However, on the morning of 22 November 1997, Hutchence, aged 37, was found dead in his room, Room 524, at the Ritz-Carlton hotel in Double Bay, Sydney. The New South Wales Coroner determined that Hutchence's death was the result of suicide. (Wikipedia) Sharon Tate (January 24, 1943 – August 9, 1969): During the 1960s she played small television roles before appearing in several films. After receiving positive reviews for her comedic performances, she was hailed as one of Hollywood's promising newcomers and was nominated for a Golden Globe Award for her performance in Valley of the Dolls (1967). Married to the film director Roman Polanski in 1968, Tate was eight and a half months pregnant when she was murdered in her home, along with four others, by followers of Charles Manson. (Wikipedia)

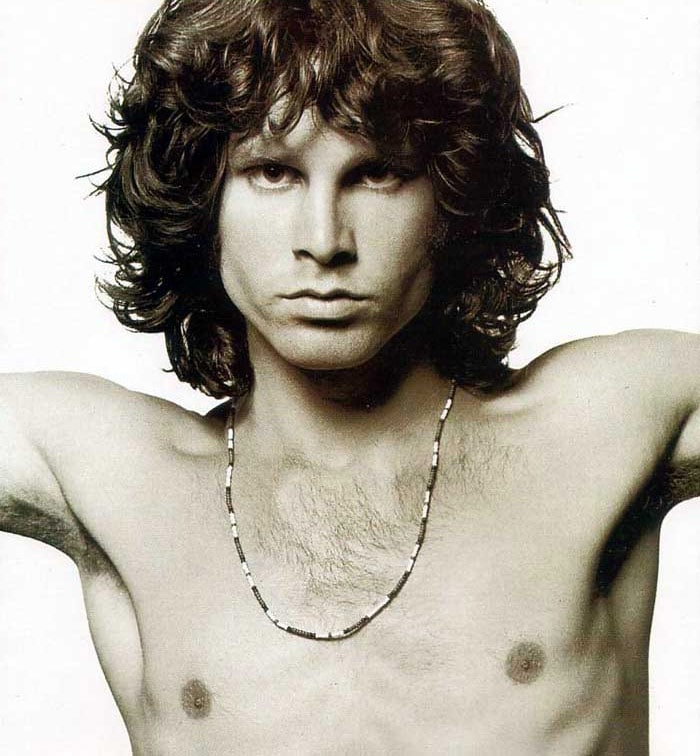

Sharon Tate (January 24, 1943 – August 9, 1969): During the 1960s she played small television roles before appearing in several films. After receiving positive reviews for her comedic performances, she was hailed as one of Hollywood's promising newcomers and was nominated for a Golden Globe Award for her performance in Valley of the Dolls (1967). Married to the film director Roman Polanski in 1968, Tate was eight and a half months pregnant when she was murdered in her home, along with four others, by followers of Charles Manson. (Wikipedia) Jim Morrison (December 8, 1943 – July 3, 1971): Best known as the lead singer and lyricist of 'The Doors', Morrison is widely considered to be one of the most charismatic frontmen in rock music history. Morrison died on July 3, 1971. In the official account of his death, he was found in a Paris apartment bathtub by Courson. Pursuant to French law, no autopsy was performed because the medical examiner claimed to have found no evidence of foul play. The absence of an official autopsy has left many questions regarding Morrison's cause of death. (Wikipedia)

Jim Morrison (December 8, 1943 – July 3, 1971): Best known as the lead singer and lyricist of 'The Doors', Morrison is widely considered to be one of the most charismatic frontmen in rock music history. Morrison died on July 3, 1971. In the official account of his death, he was found in a Paris apartment bathtub by Courson. Pursuant to French law, no autopsy was performed because the medical examiner claimed to have found no evidence of foul play. The absence of an official autopsy has left many questions regarding Morrison's cause of death. (Wikipedia) James Dean (February 8, 1931 – September 30, 1955): Dean's status as a cultural icon is best embodied in the title of his most celebrated film, Rebel Without a Cause, in which he starred as troubled Los Angeles teenager Jim Stark. On September 30, 1955, Dean and his mechanic Rolf Wütherich set off from Competition Motors, where they had prepared his Porsche 550 Spyder that morning for a sports car race at Salinas, California. En route, he was involved in a head-on collision that claimed his life. (Wikipedia)

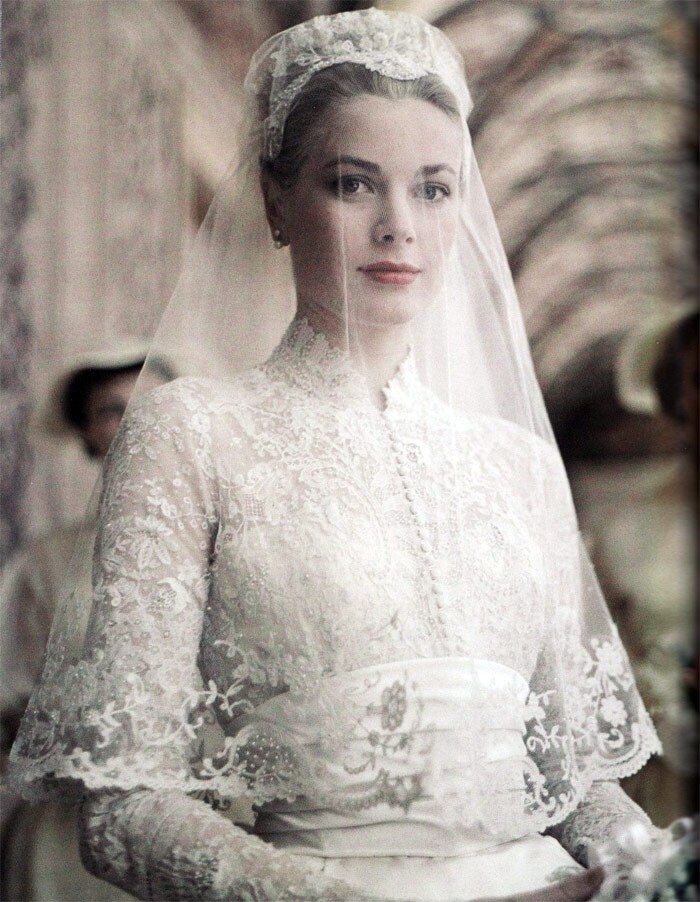

James Dean (February 8, 1931 – September 30, 1955): Dean's status as a cultural icon is best embodied in the title of his most celebrated film, Rebel Without a Cause, in which he starred as troubled Los Angeles teenager Jim Stark. On September 30, 1955, Dean and his mechanic Rolf Wütherich set off from Competition Motors, where they had prepared his Porsche 550 Spyder that morning for a sports car race at Salinas, California. En route, he was involved in a head-on collision that claimed his life. (Wikipedia) Grace Kelly (November 12, 1929 – September 14, 1982): American actress Kelly married Rainier III, Prince of Monaco in April 1956. Retiring from acting at 26, she entered upon her duties in Monaco. Her death, two months before her 53rd birthday, was the result of an automobile accident caused by cerebral hemorrhage. In June 1999, the American Film Institute ranked her #13 in their list of top female stars of American cinema. (Wikipedia)

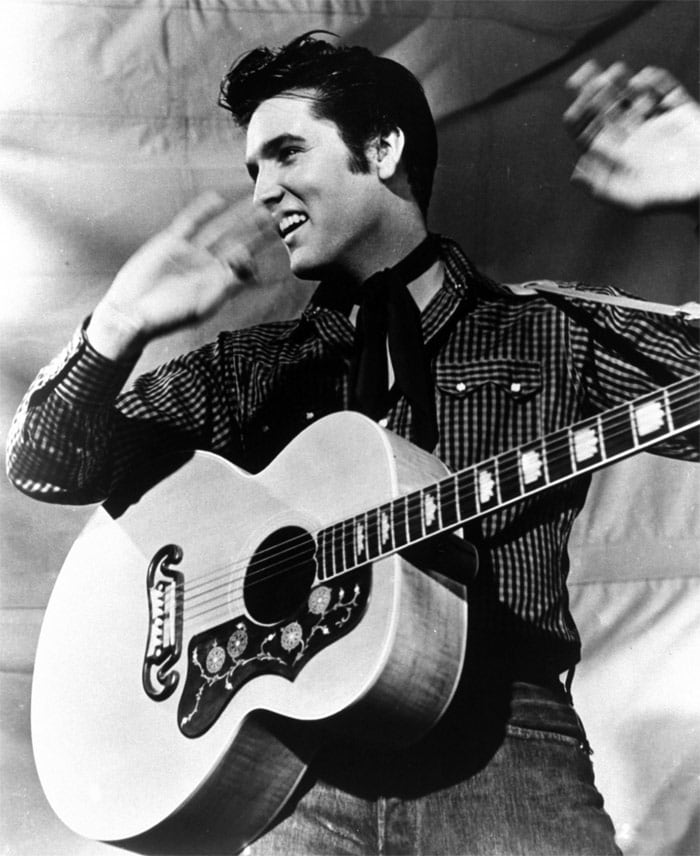

Grace Kelly (November 12, 1929 – September 14, 1982): American actress Kelly married Rainier III, Prince of Monaco in April 1956. Retiring from acting at 26, she entered upon her duties in Monaco. Her death, two months before her 53rd birthday, was the result of an automobile accident caused by cerebral hemorrhage. In June 1999, the American Film Institute ranked her #13 in their list of top female stars of American cinema. (Wikipedia) Elvis Presley (January 8, 1935 – August 16, 1977): Presley is often regarded as one of the most important figures of 20th-century popular culture. He was one of the originators of rockabilly, an uptempo, backbeat-driven fusion of country and rhythm and blues. Journalist Tony Scherman writes that by early 1977, "Elvis Presley had become a grotesque caricature of his sleek, energetic former self. Hugely overweight, his mind dulled by the pharmacopoeia he daily ingested, he was barely able to pull himself through his abbreviated concerts." In his final days, Presley suffered from multiple ailments — glaucoma, high blood pressure, liver damage, and an enlarged colon, each aggravated, and possibly caused, by drug abuse. He was scheduled to fly out of Memphis on the evening of August 16, 1977, to begin another tour. That afternoon, 'The King' was discovered unresponsive on his bathroom floor. Attempts to revive him failed, and death was officially pronounced at 3:30 pm at Baptist Memorial Hospital. (Wikipedia)

Elvis Presley (January 8, 1935 – August 16, 1977): Presley is often regarded as one of the most important figures of 20th-century popular culture. He was one of the originators of rockabilly, an uptempo, backbeat-driven fusion of country and rhythm and blues. Journalist Tony Scherman writes that by early 1977, "Elvis Presley had become a grotesque caricature of his sleek, energetic former self. Hugely overweight, his mind dulled by the pharmacopoeia he daily ingested, he was barely able to pull himself through his abbreviated concerts." In his final days, Presley suffered from multiple ailments — glaucoma, high blood pressure, liver damage, and an enlarged colon, each aggravated, and possibly caused, by drug abuse. He was scheduled to fly out of Memphis on the evening of August 16, 1977, to begin another tour. That afternoon, 'The King' was discovered unresponsive on his bathroom floor. Attempts to revive him failed, and death was officially pronounced at 3:30 pm at Baptist Memorial Hospital. (Wikipedia)

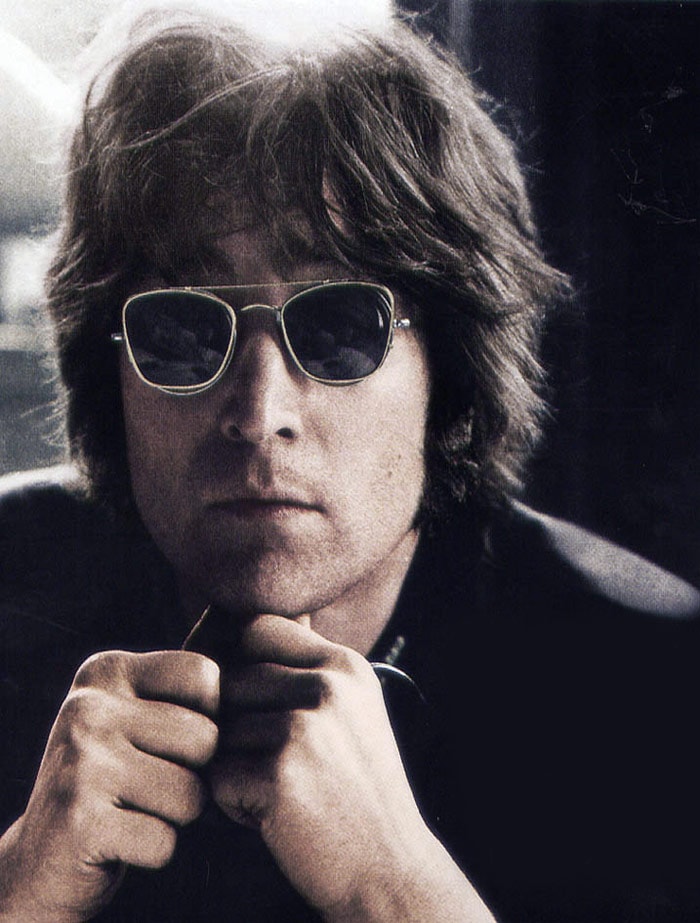

John Lennon (October 9, 1940 – December 8, 1980): With Paul McCartney, Lennon formed one of the most influential and successful songwriting partnerships of the 20th century and 'wrote some of the most popular music in rock and roll history'. After The Beatles broke up in 1970, Lennon enjoyed a successful solo career, selling 14 million albums in the US alone. After a self-imposed 'retirement' in 1975 to raise his son Sean, Lennon reemerged in 1980 with a comeback album, Double Fantasy, but was murdered less than one month after its release. On the night of 8 December 1980, at around 10:50 pm, Mark David Chapman shot Lennon in the back four times at the entrance of the Dakota apartment building. Earlier that evening, Lennon had autographed a copy of Double Fantasy for Chapman who had been stalking Lennon since October. (Wikipedia)

John Lennon (October 9, 1940 – December 8, 1980): With Paul McCartney, Lennon formed one of the most influential and successful songwriting partnerships of the 20th century and 'wrote some of the most popular music in rock and roll history'. After The Beatles broke up in 1970, Lennon enjoyed a successful solo career, selling 14 million albums in the US alone. After a self-imposed 'retirement' in 1975 to raise his son Sean, Lennon reemerged in 1980 with a comeback album, Double Fantasy, but was murdered less than one month after its release. On the night of 8 December 1980, at around 10:50 pm, Mark David Chapman shot Lennon in the back four times at the entrance of the Dakota apartment building. Earlier that evening, Lennon had autographed a copy of Double Fantasy for Chapman who had been stalking Lennon since October. (Wikipedia)

Brandon Lee (February 1, 1965 – March 31, 1993): The son of the late legendary martial arts film star Bruce Lee, Brandon was an actor and martial artist in his own right. After a promising start in action movies and the signing of a multi-film contract with 20th Century Fox, Lee was accidentally shot and killed in North Carolina at the age of 28 while filming The Crow (1994). (Wikipedia)

Brandon Lee (February 1, 1965 – March 31, 1993): The son of the late legendary martial arts film star Bruce Lee, Brandon was an actor and martial artist in his own right. After a promising start in action movies and the signing of a multi-film contract with 20th Century Fox, Lee was accidentally shot and killed in North Carolina at the age of 28 while filming The Crow (1994). (Wikipedia) Bruce Lee (November 27, 1940 - July 20, 1973): Considered by many as the most influential martial artist of the 20th century, and a cultural icon, Lee is noted for his roles in five feature length films, The Big Boss (1971), Fist of Fury (1972), Way of the Dragon (1972), Enter the Dragon (1973), and The Game of Death (1978). On May 10, 1973, Lee collapsed in Golden Harvest studios while doing dubbing work for the movie Enter the Dragon. Suffering from seizures and headaches, he was immediately rushed to Hong Kong Baptist Hospital where doctors diagnosed cerebral edema. These same symptoms that occurred in his first collapse were later repeated on the day of his death. On October 15, 2005, producer Raymond Chow stated in an interview that Lee died from a hypersensitivity to the muscle relaxant in Equagesic. His iconic status and untimely demise fed many theories about his death, including murder involving the Triad society and a supposed curse on him and his family. (Wikipedia)

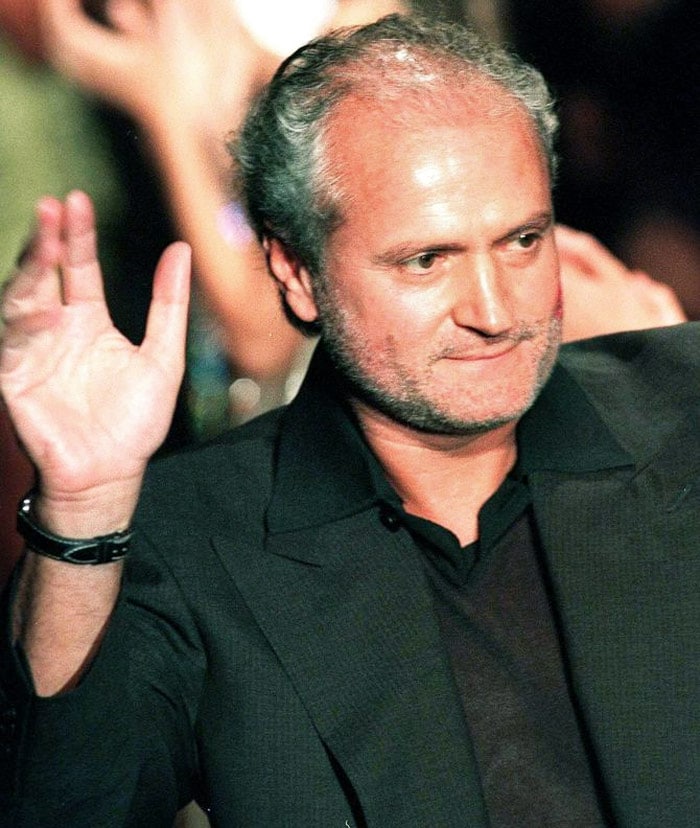

Bruce Lee (November 27, 1940 - July 20, 1973): Considered by many as the most influential martial artist of the 20th century, and a cultural icon, Lee is noted for his roles in five feature length films, The Big Boss (1971), Fist of Fury (1972), Way of the Dragon (1972), Enter the Dragon (1973), and The Game of Death (1978). On May 10, 1973, Lee collapsed in Golden Harvest studios while doing dubbing work for the movie Enter the Dragon. Suffering from seizures and headaches, he was immediately rushed to Hong Kong Baptist Hospital where doctors diagnosed cerebral edema. These same symptoms that occurred in his first collapse were later repeated on the day of his death. On October 15, 2005, producer Raymond Chow stated in an interview that Lee died from a hypersensitivity to the muscle relaxant in Equagesic. His iconic status and untimely demise fed many theories about his death, including murder involving the Triad society and a supposed curse on him and his family. (Wikipedia) Gianni Versace (December 2, 1946 – July 15, 1997): The Italian fashion designer was founder of Gianni Versace S.p.A., an international fashion house, which produces accessories, fragrances, makeup and home furnishings as well as clothes. He also designed costumes for the theatre and films, and was a friend of Elton John, Sting, and Princess Diana among many others. Versace was murdered outside his Miami Beach home at the age of 50 by spree killer Andrew Cunanan. Cunanan used the same gun to commit suicide on a boat several days later. (Wikipedia)

Gianni Versace (December 2, 1946 – July 15, 1997): The Italian fashion designer was founder of Gianni Versace S.p.A., an international fashion house, which produces accessories, fragrances, makeup and home furnishings as well as clothes. He also designed costumes for the theatre and films, and was a friend of Elton John, Sting, and Princess Diana among many others. Versace was murdered outside his Miami Beach home at the age of 50 by spree killer Andrew Cunanan. Cunanan used the same gun to commit suicide on a boat several days later. (Wikipedia) Heath Ledger (April 4, 1979 – January 22, 2008): Actor Heath Ledger's work comprises just nineteen films but he tasted both critical acclaim and huge commercial success with films like Brokeback Mountain, and The Dark Knight. He died at the age of 28, from an accidental 'toxic combination of prescription drugs'. A few months before his death, Ledger had finished filming his penultimate performance, as the Joker in The Dark Knight, his death coming during editing of the film and casting a shadow over the subsequent promotion of the $180 million production. (Wikipedia)

Heath Ledger (April 4, 1979 – January 22, 2008): Actor Heath Ledger's work comprises just nineteen films but he tasted both critical acclaim and huge commercial success with films like Brokeback Mountain, and The Dark Knight. He died at the age of 28, from an accidental 'toxic combination of prescription drugs'. A few months before his death, Ledger had finished filming his penultimate performance, as the Joker in The Dark Knight, his death coming during editing of the film and casting a shadow over the subsequent promotion of the $180 million production. (Wikipedia)

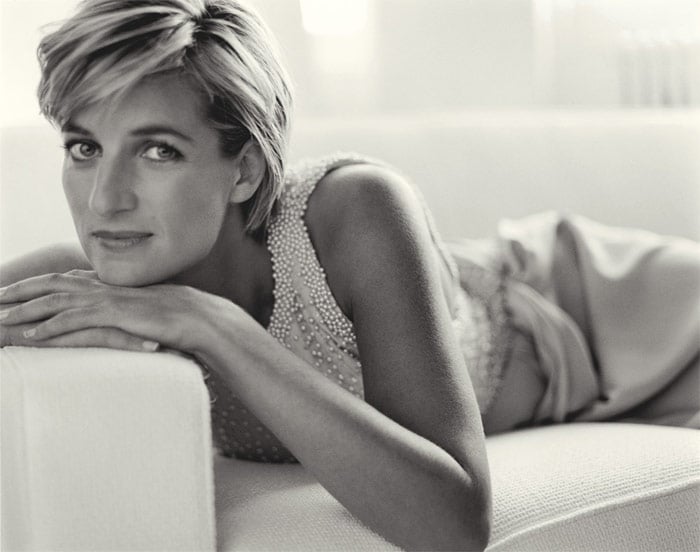

Princess Diana (July 1, 1961 – August 31, 1997): A public figure from the announcement of her engagement to Prince Charles of Britain, Diana remained the focus of near-constant media scrutiny in the United Kingdom and around the world before, during and after her marriage, even in the years following her sudden death in a car crash, which was followed by a spontaneous and prolonged show of public mourning. The long-awaited Coroner's Inquest reported its conclusion on April 7, 2008 that Diana and her companion Dodi Fayed were unlawfully killed by the negligent driving of the following vehicles and also the driver Henri Paul of the vehicle in which she was travelling. (Wikipedia)

Princess Diana (July 1, 1961 – August 31, 1997): A public figure from the announcement of her engagement to Prince Charles of Britain, Diana remained the focus of near-constant media scrutiny in the United Kingdom and around the world before, during and after her marriage, even in the years following her sudden death in a car crash, which was followed by a spontaneous and prolonged show of public mourning. The long-awaited Coroner's Inquest reported its conclusion on April 7, 2008 that Diana and her companion Dodi Fayed were unlawfully killed by the negligent driving of the following vehicles and also the driver Henri Paul of the vehicle in which she was travelling. (Wikipedia) Ruslana Korshunova (July 2, 1987 – June 28, 2008): Korshunova was a Kazakh model of Russian descent. After establishing herself as a rising figure in the fashion industry by posing for magazines like Vogue and designers such as Vera Wang and Nina Ricci, Korshunova's mysterious death after falling off her Manhattan apartment's balcony on June 28, 2008 became the subject of international attention. (Wikipedia)

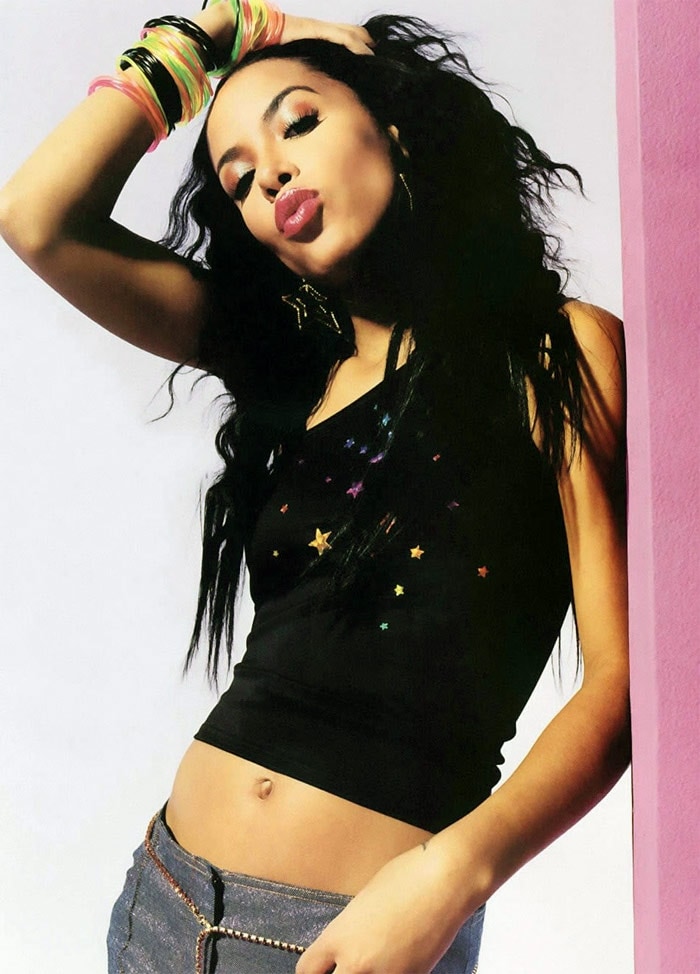

Ruslana Korshunova (July 2, 1987 – June 28, 2008): Korshunova was a Kazakh model of Russian descent. After establishing herself as a rising figure in the fashion industry by posing for magazines like Vogue and designers such as Vera Wang and Nina Ricci, Korshunova's mysterious death after falling off her Manhattan apartment's balcony on June 28, 2008 became the subject of international attention. (Wikipedia) Selena Quintanilla-Pérez (April 16, 1971 - March 31, 1995): Selena was a Mexican American singer who has been called 'The Queen of Tejano music'. She won Female Vocalist of the Year at the 1987 Tejano Music Awards and landed a recording contract with EMI a few years later. Her fame grew throughout the early 1990s, especially in Spanish-speaking countries. Selena attained further notability in North America after she was murdered at the age of 23 by Yolanda Saldívar, the president of her fan club. (Wikipedia)

Selena Quintanilla-Pérez (April 16, 1971 - March 31, 1995): Selena was a Mexican American singer who has been called 'The Queen of Tejano music'. She won Female Vocalist of the Year at the 1987 Tejano Music Awards and landed a recording contract with EMI a few years later. Her fame grew throughout the early 1990s, especially in Spanish-speaking countries. Selena attained further notability in North America after she was murdered at the age of 23 by Yolanda Saldívar, the president of her fan club. (Wikipedia) Stephen Gately (March 17, 1976 - October 10, 2009) was an Irish pop singer, songwriter and actor, who, with Ronan Keating, was one of two lead singers of the pop group Boyzone. Gately died of natural causes on October 10, 2009, due to pulmonary oedema. Gately was found squatting in an awkward way on a sofa, dressed in his pyjamas while on holiday in Majorca, Spain. Police said they had no reason to believe the death was related to abuse of substances such as drugs or alcohol and no suicide note or signs of violence were located on the corpse. (Wikipedia)

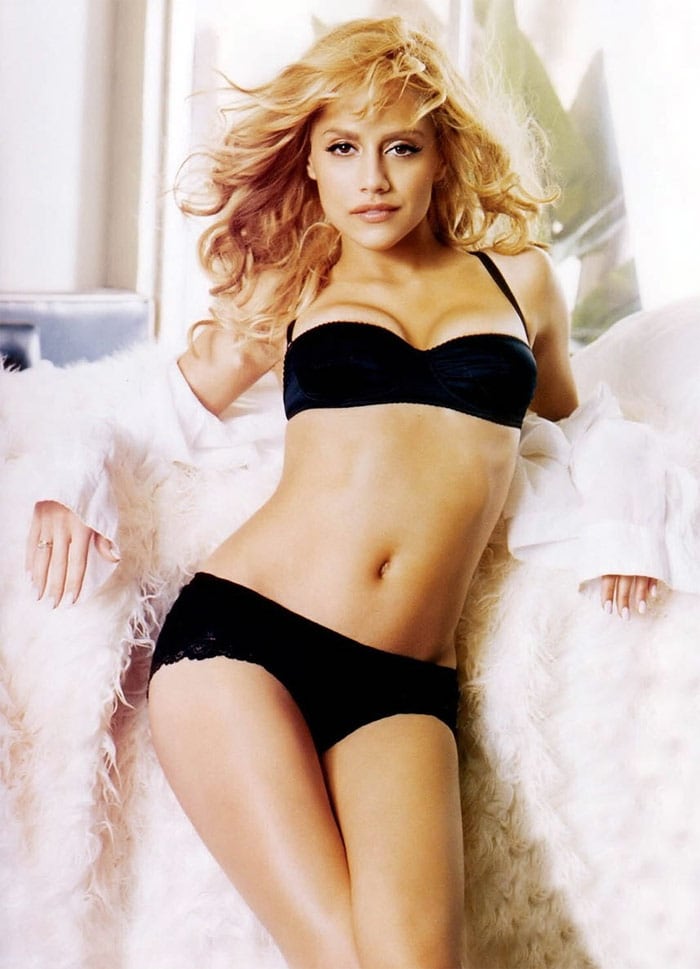

Stephen Gately (March 17, 1976 - October 10, 2009) was an Irish pop singer, songwriter and actor, who, with Ronan Keating, was one of two lead singers of the pop group Boyzone. Gately died of natural causes on October 10, 2009, due to pulmonary oedema. Gately was found squatting in an awkward way on a sofa, dressed in his pyjamas while on holiday in Majorca, Spain. Police said they had no reason to believe the death was related to abuse of substances such as drugs or alcohol and no suicide note or signs of violence were located on the corpse. (Wikipedia) Brittany Murphy (November 10, 1977 - December 20, 2009): On December 20, 2009, the star of films like Clueless, Girl, Interrupted, Nikki, Uptown Girls, Sin City, Happy Feet, and Riding in Cars with Boys apparently collapsed in the bathroom of the house that she shared with her husband Simon Monjack. Firefighters attempted to resuscitate Murphy on the scene. She was subsequently transported to Cedars-Sinai Medical Center, where she was pronounced dead on arrival after going into cardiac arrest. (Wikipedia)

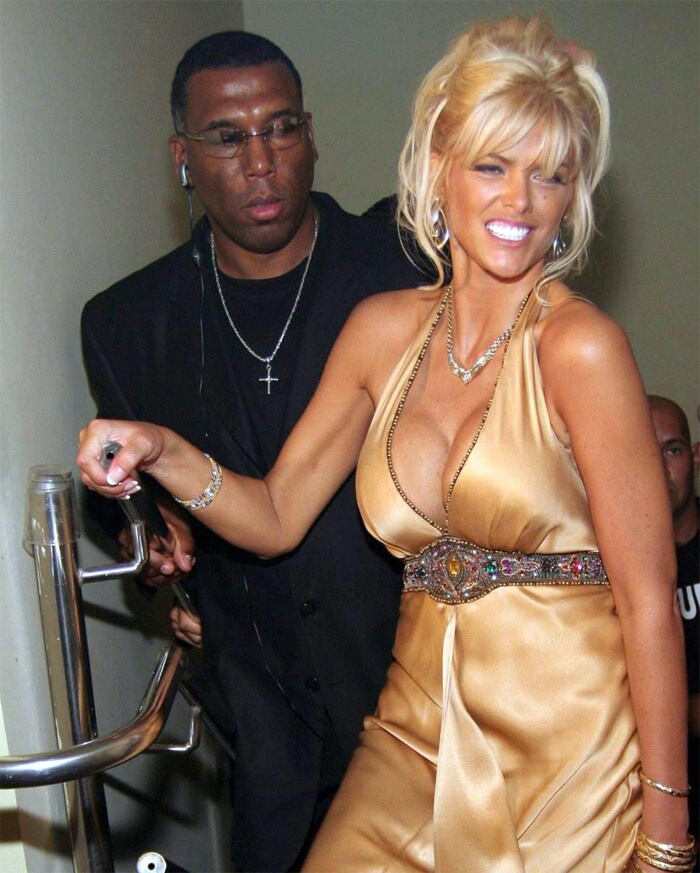

Brittany Murphy (November 10, 1977 - December 20, 2009): On December 20, 2009, the star of films like Clueless, Girl, Interrupted, Nikki, Uptown Girls, Sin City, Happy Feet, and Riding in Cars with Boys apparently collapsed in the bathroom of the house that she shared with her husband Simon Monjack. Firefighters attempted to resuscitate Murphy on the scene. She was subsequently transported to Cedars-Sinai Medical Center, where she was pronounced dead on arrival after going into cardiac arrest. (Wikipedia) Marilyn Monroe (June 1, 1926 - August 5, 1962): Monroe is one of the most iconic and well-recognised entertainment figures the world over. Born Norma Jeane Mortenson, the actress, singer, and model was seen in films like Gentlemen Prefer Blondes, How to Marry a Millionaire, Some Like It Hot and The Seven Year Itch. The final years of Monroe's life were marked by illness, personal problems, and a reputation for being unreliable and difficult to work with. The circumstances of her death, from an overdose of barbiturates, have been the subject of conjecture. Though officially classified as a 'probable suicide', the possibility of an accidental overdose, as well as that of homicide, have not been ruled out. (Wikipedia)

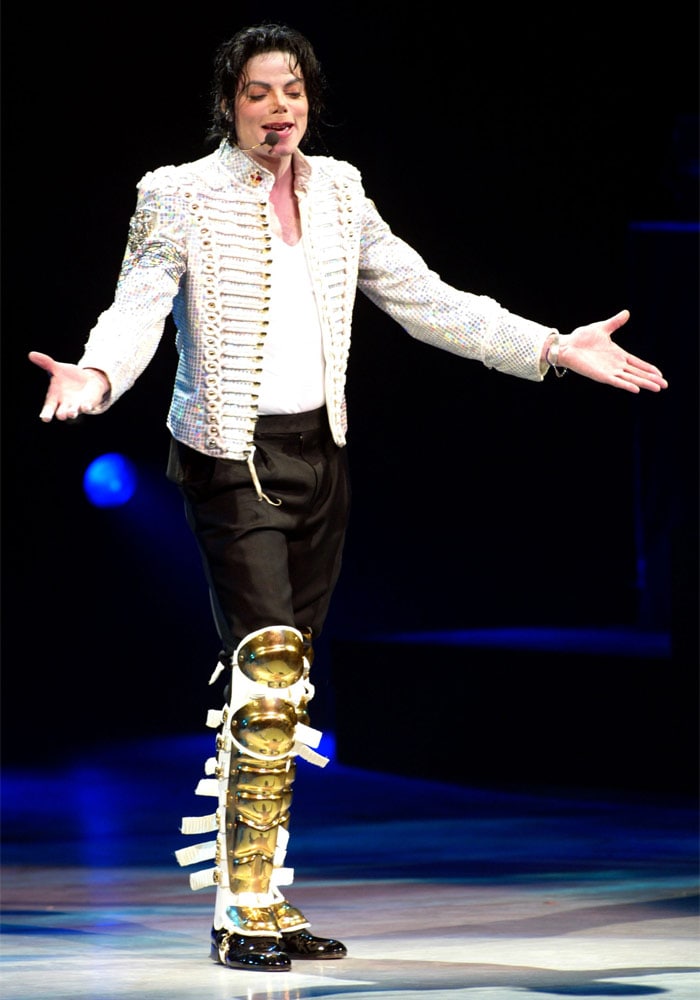

Marilyn Monroe (June 1, 1926 - August 5, 1962): Monroe is one of the most iconic and well-recognised entertainment figures the world over. Born Norma Jeane Mortenson, the actress, singer, and model was seen in films like Gentlemen Prefer Blondes, How to Marry a Millionaire, Some Like It Hot and The Seven Year Itch. The final years of Monroe's life were marked by illness, personal problems, and a reputation for being unreliable and difficult to work with. The circumstances of her death, from an overdose of barbiturates, have been the subject of conjecture. Though officially classified as a 'probable suicide', the possibility of an accidental overdose, as well as that of homicide, have not been ruled out. (Wikipedia) Michael Jackson (August 29, 1958 - June 25, 2009): Jackson was perhaps the most successful entertainer of all time, and certainly one of the most influential. His contributions to music, dance and fashion, and a much-publicised personal life, made him a global figure in popular culture for over four decades. On June 25, 2009, Jackson never woke up from his evening sleep at his rented mansion at 100 North Carolwood Drive in the Holmby Hills district of Los Angeles. All attempts at resuscitating him failed and The King of Pop was pronounced dead at 2:26 p.m. local time. On August 24 several news outlets reported that the Los Angeles coroner had decided to treat Jackson's death as a homicide; this was later confirmed by the coroner on August 28. (Wikipedia)

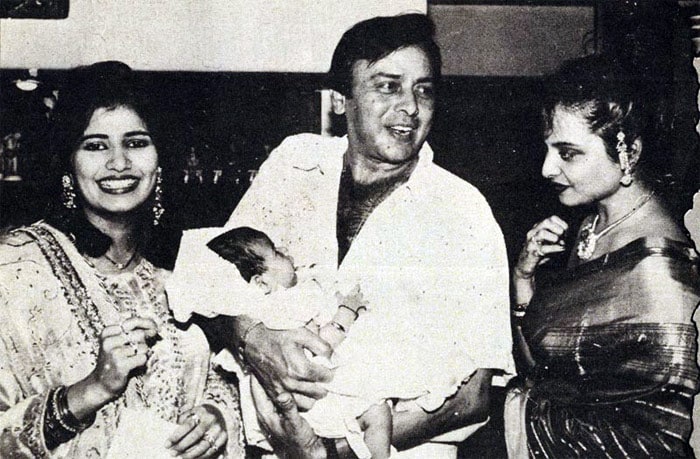

Michael Jackson (August 29, 1958 - June 25, 2009): Jackson was perhaps the most successful entertainer of all time, and certainly one of the most influential. His contributions to music, dance and fashion, and a much-publicised personal life, made him a global figure in popular culture for over four decades. On June 25, 2009, Jackson never woke up from his evening sleep at his rented mansion at 100 North Carolwood Drive in the Holmby Hills district of Los Angeles. All attempts at resuscitating him failed and The King of Pop was pronounced dead at 2:26 p.m. local time. On August 24 several news outlets reported that the Los Angeles coroner had decided to treat Jackson's death as a homicide; this was later confirmed by the coroner on August 28. (Wikipedia) Vinod Mehra (February 13, 1945 - October 30, 1990): He started out as a child actor in a few films before starting his adult film career in 1971. Some of his prominent films include Nagin, Jaani Dushman, Khud-Daar, Anurodh, Amardeep, and Bemisal. He had turned producer and director with the film Gurudev in the late 1980s, with Sridevi, Rishi Kapoor and Anil Kapoor in the lead, but he suddenly died of a heart attack before completion of the film at the age of 45 in October 1990. (Wikipedia) In the photo, Vinod Mehra is seen with his daughter Soniya, his last wife Kiran (1st L) and supposedly at one time wife, actress Rekha.

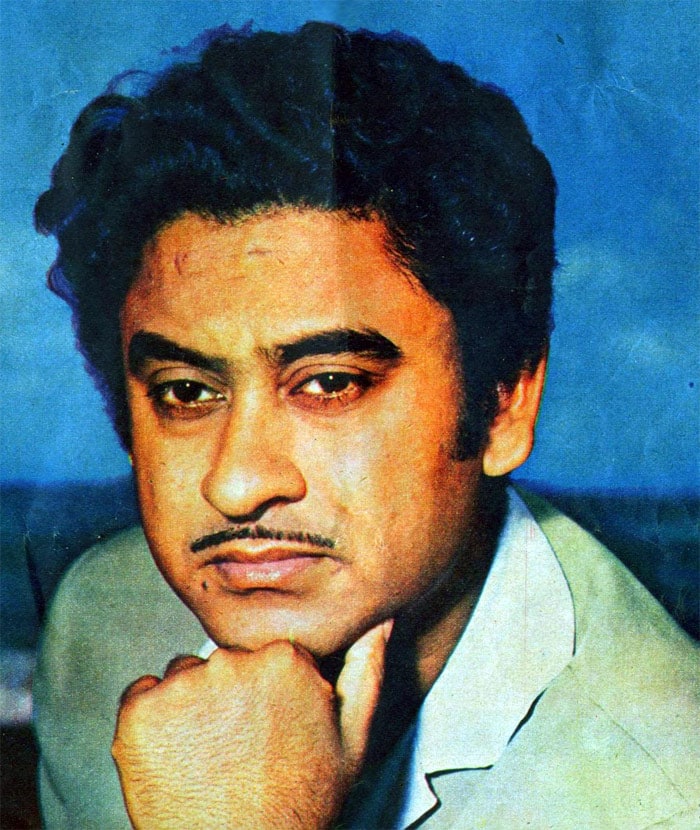

Vinod Mehra (February 13, 1945 - October 30, 1990): He started out as a child actor in a few films before starting his adult film career in 1971. Some of his prominent films include Nagin, Jaani Dushman, Khud-Daar, Anurodh, Amardeep, and Bemisal. He had turned producer and director with the film Gurudev in the late 1980s, with Sridevi, Rishi Kapoor and Anil Kapoor in the lead, but he suddenly died of a heart attack before completion of the film at the age of 45 in October 1990. (Wikipedia) In the photo, Vinod Mehra is seen with his daughter Soniya, his last wife Kiran (1st L) and supposedly at one time wife, actress Rekha. Kishore Kumar (August 4, 1929 - October 13, 1987): Kumar won millions of hearts, as a playback singer, actor and filmmaker. He was a prolific vocalist and sang in many Indian languages including Bengali, Hindi, Marathi, Assamese, Gujarati, Kannada, Bhojpuri, Malayalam and Oriya. In October 1987, he died following a massive heart attack. He had been married four times and is survived by his two sons Amit Kumar and Sumit Kumar. (Wikipedia)

Kishore Kumar (August 4, 1929 - October 13, 1987): Kumar won millions of hearts, as a playback singer, actor and filmmaker. He was a prolific vocalist and sang in many Indian languages including Bengali, Hindi, Marathi, Assamese, Gujarati, Kannada, Bhojpuri, Malayalam and Oriya. In October 1987, he died following a massive heart attack. He had been married four times and is survived by his two sons Amit Kumar and Sumit Kumar. (Wikipedia) Sanjeev Kumar (July 9, 1938 - November 6, 1985): One of the most talented Bollywood actors, Sanjeev Kumar made his debut in Hum Hindustani in 1960 and never looked back. His most memorable films include Aandhi, Mausam, Angoor, Namkeen, Shatranj Ke Khiladi, Sholay and Trishul. In 1985, when he was 47 years old, he died of a heart ailment. Ironically for an actor who played many elderly roles, he did not live to the age of 50. (Wikipedia)

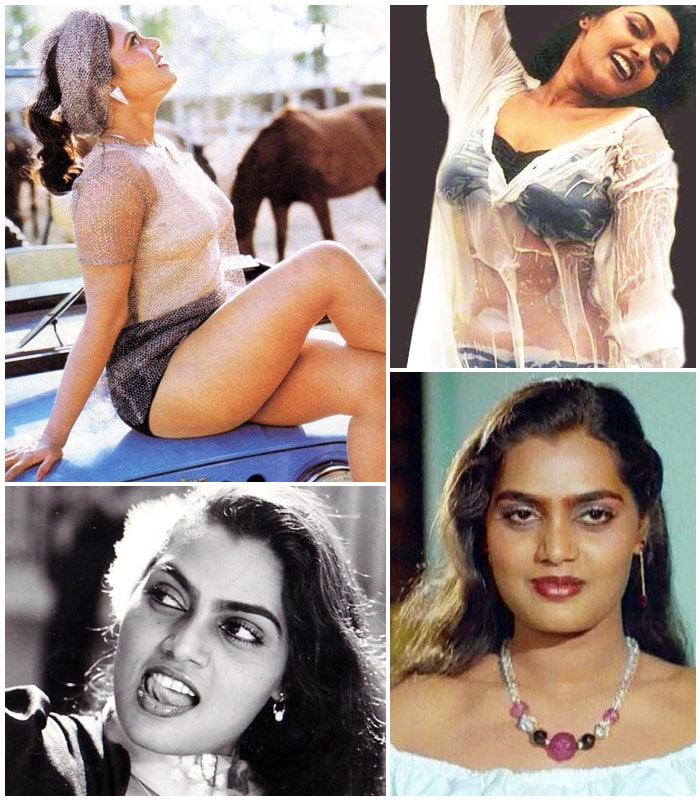

Sanjeev Kumar (July 9, 1938 - November 6, 1985): One of the most talented Bollywood actors, Sanjeev Kumar made his debut in Hum Hindustani in 1960 and never looked back. His most memorable films include Aandhi, Mausam, Angoor, Namkeen, Shatranj Ke Khiladi, Sholay and Trishul. In 1985, when he was 47 years old, he died of a heart ailment. Ironically for an actor who played many elderly roles, he did not live to the age of 50. (Wikipedia) Silk Smitha (December 2, 1960 - September 23, 1996): The South Indian actress starred in over 200 Tamil, Malayalam, Telugu, Kannada and a few Hindi films during her lifetime. Her dance numbers and her bold performances in films like Moondru Mugam have made her the ultimate symbol of sensuality in Tamil, Kannada. Malayalam and Telugu cinema. In 1996, Smitha was found dead in her Chennai apartment. Financial problems, a disillusionment in love and an alcohol dependency apparently led to depression. It is suspected that Smitha committed suicide. (Wikipedia)

Silk Smitha (December 2, 1960 - September 23, 1996): The South Indian actress starred in over 200 Tamil, Malayalam, Telugu, Kannada and a few Hindi films during her lifetime. Her dance numbers and her bold performances in films like Moondru Mugam have made her the ultimate symbol of sensuality in Tamil, Kannada. Malayalam and Telugu cinema. In 1996, Smitha was found dead in her Chennai apartment. Financial problems, a disillusionment in love and an alcohol dependency apparently led to depression. It is suspected that Smitha committed suicide. (Wikipedia) Parveen Babi (April 4, 1949 - January 20, 2005): Babi acted alongside top heroes of the 1970s and early 80s and is remembered for her glamorous roles in films like Deewar, Namak Halaal, Amar Akbar Anthony and Shaan. She was diabetic for most of her life - possibly due to the side-effects of powerful anti-psychotic medications. Babi was found dead in her Mumbai apartment on January 20, 2005 after her residential society secretary alerted the police that she had not collected milk and newspapers from her doorstep for two days. She was found to have gangrene of the foot as a complication of her diabetic condition. The police ruled out any foul play. (Wikipedia)

Parveen Babi (April 4, 1949 - January 20, 2005): Babi acted alongside top heroes of the 1970s and early 80s and is remembered for her glamorous roles in films like Deewar, Namak Halaal, Amar Akbar Anthony and Shaan. She was diabetic for most of her life - possibly due to the side-effects of powerful anti-psychotic medications. Babi was found dead in her Mumbai apartment on January 20, 2005 after her residential society secretary alerted the police that she had not collected milk and newspapers from her doorstep for two days. She was found to have gangrene of the foot as a complication of her diabetic condition. The police ruled out any foul play. (Wikipedia) Priya Rajvansh (1937 - March 27, 2000): Priya Rajvansh did only a handful of films during her career, among them Heer Ranjha (1970) and Hanste Zakhm (1973). Rajvansh and filmmaker Chetan Anand had a personal relationship and lived-in. After Anand's death in 1997, she inherited a part of his property along with his sons from his first marriage. She was murdered on March 27, 2000 in Anand's Ruia Park bungalow in Juhu, Mumbai. Police charged Anand's sons Ketan Anand and Vivek Anand along with their employees Mala Choudhary and Ashok Chinnaswamy with her murder. The four accused were convicted and sentenced to life imprisonment in July 2002. (Wikipedia)

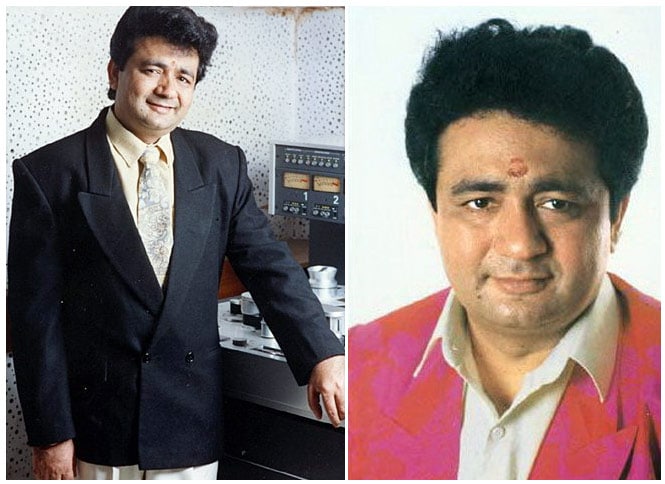

Priya Rajvansh (1937 - March 27, 2000): Priya Rajvansh did only a handful of films during her career, among them Heer Ranjha (1970) and Hanste Zakhm (1973). Rajvansh and filmmaker Chetan Anand had a personal relationship and lived-in. After Anand's death in 1997, she inherited a part of his property along with his sons from his first marriage. She was murdered on March 27, 2000 in Anand's Ruia Park bungalow in Juhu, Mumbai. Police charged Anand's sons Ketan Anand and Vivek Anand along with their employees Mala Choudhary and Ashok Chinnaswamy with her murder. The four accused were convicted and sentenced to life imprisonment in July 2002. (Wikipedia) Gulshan Kumar (May 5, 1956 - August 12, 1997): 'Cassette King' Gulshan Kumar, the founder of the T-Series music label (Super Cassettes Industries Ltd.), was killed outside the Jeeteshwar Mahadev Mandir, a Hindu temple in Jeet Nagar, Andheri West suburb of Mumbai on August 12, 1997. The police accused Nadeem of the music duo Nadeem-Shravan of having paid for the assassination. However, on January 9, 2001, Abdul Rauf (known as 'Raja') confessed to being the assassin. Rauf was sentenced to life imprisonment for the crime. (Wikipedia)

Gulshan Kumar (May 5, 1956 - August 12, 1997): 'Cassette King' Gulshan Kumar, the founder of the T-Series music label (Super Cassettes Industries Ltd.), was killed outside the Jeeteshwar Mahadev Mandir, a Hindu temple in Jeet Nagar, Andheri West suburb of Mumbai on August 12, 1997. The police accused Nadeem of the music duo Nadeem-Shravan of having paid for the assassination. However, on January 9, 2001, Abdul Rauf (known as 'Raja') confessed to being the assassin. Rauf was sentenced to life imprisonment for the crime. (Wikipedia) Nargis (June 1, 1929 - May 3, 1981): She is widely regarded as one of the greatest actresses in the history of Hindi cinema and remembered for her performances in films like Mother India, Barsaat, Andaz, Awaara, Shree 420 and Chori Chori. Nargis was diagnosed with pancreatic cancer and underwent treatment for the disease at Memorial Sloan-Kettering Cancer Center in New York. Upon her return to India, her condition deteriorated, and she was admitted to Breach Candy Hospital in Mumbai. She sank into a coma on May 2, 1981 and died on May 3, 1981. (Wikipedia)

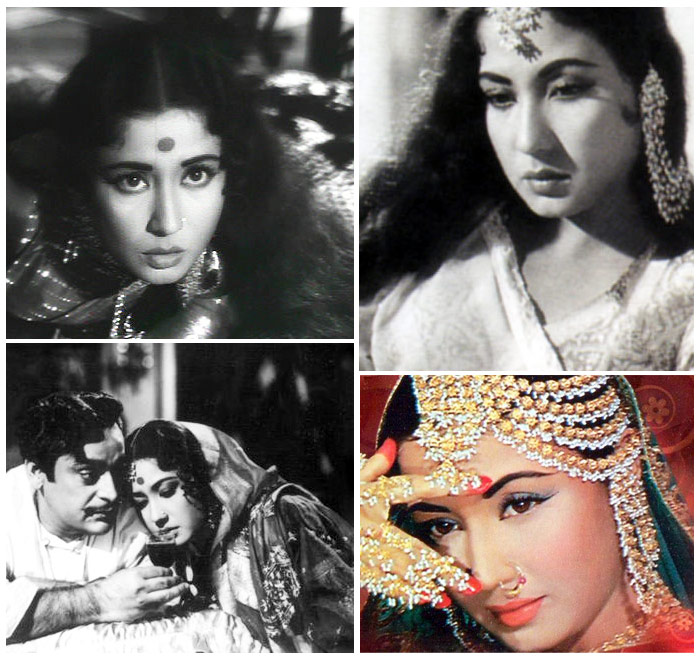

Nargis (June 1, 1929 - May 3, 1981): She is widely regarded as one of the greatest actresses in the history of Hindi cinema and remembered for her performances in films like Mother India, Barsaat, Andaz, Awaara, Shree 420 and Chori Chori. Nargis was diagnosed with pancreatic cancer and underwent treatment for the disease at Memorial Sloan-Kettering Cancer Center in New York. Upon her return to India, her condition deteriorated, and she was admitted to Breach Candy Hospital in Mumbai. She sank into a coma on May 2, 1981 and died on May 3, 1981. (Wikipedia) Meena Kumari (August 1, 1932 - March 31, 1972): She gained a reputation for tragic roles in films like Sahib Bibi Aur Ghulam, Baiju Bawra, Dil Ek Mandir and Dil Apna Aur Preet Parayi. After divorcing her husband Kamal Amrohi in 1964, her addiction to alcohol became stronger, and she often dulled her senses with liquor. Kumari's heavy drinking had badly damaged her liver, and in 1968 she fell seriously ill. She was taken to London and Switzerland for treatment. Three weeks after the release of Pakeezah, Meena Kumari became seriously ill, and died on March 31, 1972 of cirrhosis of the liver. (Wikipedia)

Meena Kumari (August 1, 1932 - March 31, 1972): She gained a reputation for tragic roles in films like Sahib Bibi Aur Ghulam, Baiju Bawra, Dil Ek Mandir and Dil Apna Aur Preet Parayi. After divorcing her husband Kamal Amrohi in 1964, her addiction to alcohol became stronger, and she often dulled her senses with liquor. Kumari's heavy drinking had badly damaged her liver, and in 1968 she fell seriously ill. She was taken to London and Switzerland for treatment. Three weeks after the release of Pakeezah, Meena Kumari became seriously ill, and died on March 31, 1972 of cirrhosis of the liver. (Wikipedia) Madhubala (February 14, 1933 - February 23, 1969): In the short time that she graced the silver screen in India, Madhubala achieved the kind of iconic status that many actors can only dream of. She was found to have a heart problem after she coughed up blood in 1950. She was discovered to have been born with a ventricular septal defect, commonly known as a 'hole in the heart'. At the time, heart surgery was not widely available. In 1960, Madhubala sought treatment in London as her condition deteriorated. After an examination the doctors there refused to operate, convinced her chances of surviving the procedure were minimal. Madhubala finally succumbed to her illness and died on February 23, 1969, shortly after her 36th birthday. (Wikipedia)

Madhubala (February 14, 1933 - February 23, 1969): In the short time that she graced the silver screen in India, Madhubala achieved the kind of iconic status that many actors can only dream of. She was found to have a heart problem after she coughed up blood in 1950. She was discovered to have been born with a ventricular septal defect, commonly known as a 'hole in the heart'. At the time, heart surgery was not widely available. In 1960, Madhubala sought treatment in London as her condition deteriorated. After an examination the doctors there refused to operate, convinced her chances of surviving the procedure were minimal. Madhubala finally succumbed to her illness and died on February 23, 1969, shortly after her 36th birthday. (Wikipedia) Guru Dutt (July 9, 1925 - October 10, 1964): Often credited with ushering in the golden era of Hindi cinema, Dutt made quintessential 1950s and 1960s classics such as Pyaasa, Kaagaz Ke Phool, Sahib Bibi Aur Ghulam and Chaudhvin Ka Chand. On October 10, 1964, he was found dead in his bed in his rented apartment at Pedder Road in Mumbai. He is said to have been mixing alcohol and sleeping pills. His death may have been suicide, or just an accidental overdose. It would have been his third suicide attempt. (Wikipedia)

Guru Dutt (July 9, 1925 - October 10, 1964): Often credited with ushering in the golden era of Hindi cinema, Dutt made quintessential 1950s and 1960s classics such as Pyaasa, Kaagaz Ke Phool, Sahib Bibi Aur Ghulam and Chaudhvin Ka Chand. On October 10, 1964, he was found dead in his bed in his rented apartment at Pedder Road in Mumbai. He is said to have been mixing alcohol and sleeping pills. His death may have been suicide, or just an accidental overdose. It would have been his third suicide attempt. (Wikipedia) Smita Patil (October 17, 1955 - December 13, 1986): Along with actress and co-star Shabana Azmi, she was one of the potent quartet representing India's parallel cinema. Her performances were often acclaimed, and she was mostly noted for her work in such art films as Manthan (1977), Bhumika (1977), Aakrosh (1980) and Chakra (1981). Smita died from childbirth complications on December 13, 1986, aged 31, barely 6 hours after having given birth to her son, Prateek Babbar. Nearly two decades later, one of India's greatest film directors, Mrinal Sen alleged that Smita Patil had died due to gross medical negligence. (Wikipedia)

Smita Patil (October 17, 1955 - December 13, 1986): Along with actress and co-star Shabana Azmi, she was one of the potent quartet representing India's parallel cinema. Her performances were often acclaimed, and she was mostly noted for her work in such art films as Manthan (1977), Bhumika (1977), Aakrosh (1980) and Chakra (1981). Smita died from childbirth complications on December 13, 1986, aged 31, barely 6 hours after having given birth to her son, Prateek Babbar. Nearly two decades later, one of India's greatest film directors, Mrinal Sen alleged that Smita Patil had died due to gross medical negligence. (Wikipedia) Ishmeet Singh Sodhi (September 2, 1988 - July 29, 2008): In July 2008, Singh, winner of Amul STAR Voice of India 2007, went on a visit to the Maldives with fellow contestants Sumitra and Vyom for a concert that was to be held on August 1, 2008. He died on July 29, 2008, drowning in the swimming pool of the Chaaya Island Dhonveli resort in Male where he was staying. Ishmeet's family suspect that he has been murdered and have listed the reasons why on the Ishmeet Singh Foundation website. (Wikipedia)

Ishmeet Singh Sodhi (September 2, 1988 - July 29, 2008): In July 2008, Singh, winner of Amul STAR Voice of India 2007, went on a visit to the Maldives with fellow contestants Sumitra and Vyom for a concert that was to be held on August 1, 2008. He died on July 29, 2008, drowning in the swimming pool of the Chaaya Island Dhonveli resort in Male where he was staying. Ishmeet's family suspect that he has been murdered and have listed the reasons why on the Ishmeet Singh Foundation website. (Wikipedia) Divya Bharti (February 25, 1974 - April 5, 1993): She started her career in 1990 with Telugu films making her debut in Bobbili Raja. After several other hits in the South, she entered Hindi films with Vishwatma in 1992. Around midnight on April 5, 1993, Divya fell to her death off her husband Sajid Nadiadwala's 5-storey apartment building, Tulsi 2 in Mumbai. There were numerous speculations regarding Divya's sudden demise, including the possibility of accidental death, suicide and even murder. Police closed the investigation into her death in 1998, but the circumstances of her death still remain murky. (Wikipedia)

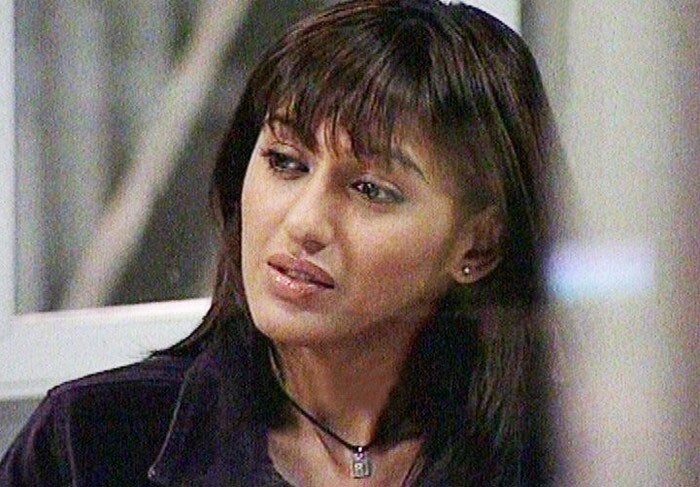

Divya Bharti (February 25, 1974 - April 5, 1993): She started her career in 1990 with Telugu films making her debut in Bobbili Raja. After several other hits in the South, she entered Hindi films with Vishwatma in 1992. Around midnight on April 5, 1993, Divya fell to her death off her husband Sajid Nadiadwala's 5-storey apartment building, Tulsi 2 in Mumbai. There were numerous speculations regarding Divya's sudden demise, including the possibility of accidental death, suicide and even murder. Police closed the investigation into her death in 1998, but the circumstances of her death still remain murky. (Wikipedia) Kuljeet Randhawa (January 1, 1976 - February 8, 2006): The actress and model was best known for her role in the Kohinoor-series. Randhawa also appeared in several television series including Hip Hip Hurray, C.A.T.S., and a lead role in STAR One's Special Squad. On February 8, 2006, Randhawa hanged herself at her apartment in Mumbai. In a suicide note, Kuljeet stated that she was ending her life as she was unable to cope with life's pressures. (Wikipedia)

Kuljeet Randhawa (January 1, 1976 - February 8, 2006): The actress and model was best known for her role in the Kohinoor-series. Randhawa also appeared in several television series including Hip Hip Hurray, C.A.T.S., and a lead role in STAR One's Special Squad. On February 8, 2006, Randhawa hanged herself at her apartment in Mumbai. In a suicide note, Kuljeet stated that she was ending her life as she was unable to cope with life's pressures. (Wikipedia)